Posts

You could potentially subtract projected tax repayments you made in the 12 months in order to your state or state. Although not, you really need to have a fair cause for putting some projected tax payments. People estimated county or local taxation costs one aren’t made in good faith casino Europa mobile in the course of commission aren’t allowable. Their deduction is generally to possess withheld fees, projected tax money, and other tax money as follows. The product quality deduction to possess a decedent’s last income tax get back is the identical to it might were had the decedent continued so you can real time.

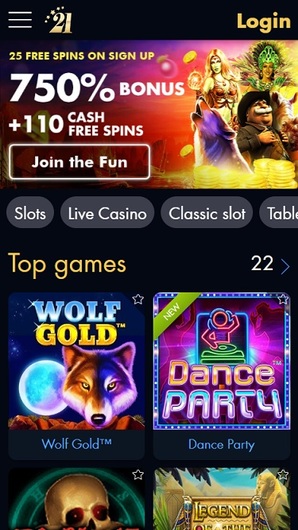

Casino Europa mobile – Tramway provider

- Unemployment compensation fundamentally boasts any matter gotten less than a jobless settlement rules of the United states otherwise away from your state.

- While you are thinking-functioning and rehearse your car on your own team, you might subtract the organization part of county and you will local individual property fees to your motor vehicles to the Schedule C (Form 1040) otherwise Schedule F (Mode 1040).

- Learn how to attention the new disallowance several months in the Guidelines to own Setting 8862, to find out more on which doing for those who disagree with the commitment you could’t allege the financing for a few otherwise a decade.

People net gain your import for the recharacterized share try addressed since the gained in the 2nd IRA. A professional package is just one that fits the requirements of the brand new Internal Revenue Password. You can make one rollover from a keen IRA to a different (and/or exact same) IRA in just about any 1-seasons period, long lasting quantity of IRAs you possess.

Put Insurance coverage Frequently asked questions

Take note one while this choice head deposit strategy worked for most, eventually, the sole one hundred% foolproof way is to complete a genuine head put of the employer salary otherwise authorities benefits. For individuals who’re new to bank incentives, recall banking companies get change what truly matters otherwise doesn’t matter because the a primary deposit any moment. In person, both I actually do force transmits from a couple of some other banking institutions to improve the potential for success. For everybody other intents and aim, truth be told there extremely isn’t a positive change between them, but for causing bank bonuses, banking companies is only going to believe force transmits since the something qualifies since the an immediate put. All legal sports betting internet sites in america render the people with fantastic indication-upwards campaigns.

$step one deposit casinos having 100 percent free spin bonuses

Otherwise render your employer a complete Setting W-cuatro, your employer must withhold in the large rate, just like you was solitary. 505 or the worksheets added to Form W-4, to decide whether you ought to have your own withholding improved or decreased.. If the situations in the 2025 will vary the level of withholding your would be to allege for 2026, you should render your employer a different Form W-cuatro by December step one, 2025. If the experience happens in December 2025, fill in a new Form W-4 within this 10 months. When you start a new employment, you must complete Mode W-cuatro and give it on the workplace.

Therefore, the companion doesn’t satisfy it ensure that you you could’t claim her or him while the a reliant. Should your based passed away inside the 12 months and you also if you don’t qualify to help you say that individual as the a centered, you could nonetheless claim that people while the a depending. You are in a position to eliminate children since your being qualified cousin even if the son could have been kidnapped.

You’ll observe that all the amounts within diversity has 9 digits, and therefore the word “9 data”. The list of individuals who secure $100 million or more annually is basically inhabited by highly effective advertisers and you will people. With regards to antique careers, it’s almost impossible to get to the 9 contour a year endurance.

Popular payment strategies for $1 deposits

Essentially, a married partners can be’t document a joint come back in the event the each one are a great nonresident alien when within the tax 12 months. However, if an individual spouse are a great nonresident alien or twin-status alien who was simply hitched in order to an excellent You.S. citizen or resident alien at the conclusion of the entire year, the brand new spouses can pick to document a shared go back. Should you file a mutual go back, you and your spouse are each other addressed since the You.S. residents for the whole taxation season. Attach a signed statement to the return outlining that the mate is actually helping in the a battle zone. For more information on special income tax laws and regulations to have persons that providing in the a fight area, or who’re inside destroyed status right down to serving in the a fight area, see Pub. You’re kept together and individually responsible for people taxation, interest, and you can charges owed on the a joint go back filed before their separation and divorce.

The following type of money are handled while the pension otherwise annuity income and are taxable underneath the laws told me within the Bar. Jury responsibility pay you receive should be utilized in your income on the Plan 1 (Mode 1040), range 8h. You’re capable ban of money the attention from qualified You.S. savings bonds you redeem if you shell out accredited advanced schooling costs in identical season. More resources for that it exemption, find Degree Deals Thread System less than U.S.

- Regarding your first drawback, it’s finest when on line sportsbooks provide personal incentive bet loans ($twenty-five per, such) unlike a lump sum.

- Do not enter into any information regarding you to range, and also finish the spaces lower than one line.

- Now, an archive 15 someone cut it for the Forbes’ 2025 World’s Billionaires listing, up of 14 this past year and you can half dozen inside 2023.

- Although not, because the compensation wasn’t managed as the wages otherwise as the almost every other nonexempt earnings, you can’t deduct the costs.

Productive December 30, 2010 all the noninterest-results transaction put membership is totally covered for your number regarding the put account. That it endless insurance policies are short term and certainly will stay static in feeling whatsoever FDIC-covered depository organizations due to December 31, 2012. Hard rock Wager has several financial methods for participants to choose out of, in addition to lender transfers, debit notes, PayPal, and Venmo.

You can make distributions from your own Red dog account with credit cards, cryptocurrency, otherwise bank cord. 9 data is the vary from $one hundred million and you may $999.9 million, which can be quantities of currency very highest that all somebody don’t connect with them most meaningfully. To show, you want to declare that the common American produces ranging from $1.13 and you will $step 3.05 million inside their whole existence.

You’re a great 22-year-dated pupil and certainly will getting said while the a centered to the the parents’ 2024 taxation return. You have $step 1,five hundred within the interest money and you may wages out of $step three,800 without itemized write-offs. You add lines 1 and you can dos and you will enter into $cuatro,250 ($step 3,800 + $450) on the internet 3.

ParlayPlay Extra Give

Register for your selected $step one put local casino Canada and you can turn on your bank account by providing the newest expected suggestions. Newbies is asked with a c$one thousand reward that can be used in order to win a number of cash once they score happy. However, the brand new wagering dependence on 70x is on the brand new higher front. Despite that, Spin Gambling enterprise is a top platform providing safe money and huge perks.

Your state costs a yearly automobile subscription income tax of 1% of value in addition to 50 dollars for every hundredweight. Your repaid $32 in accordance with the really worth ($step one,500) and you can weight (step 3,400 lbs.) of one’s vehicle. You could potentially subtract $15 (1% × $step 1,500) because the a personal property income tax because it’s according to the well worth. The remaining $17 ($0.50 × 34), based on the weight, isn’t allowable. Should your taxing authority (or lending company) doesn’t give you a copy of your own a property goverment tax bill, request it..